Ruben Cespedes

Menu

Role & Scope

I worked as a Senior Product Designer. I owned the end-to-end mobile UX and UI design for the MVP, from problem definition through final production designs. I collaborated closely with product managers, engineers, data partners, and stakeholders to align user needs with business goals and ship a focused mobile experience within a tight timeline.

Context & Problem

Stash serves millions of mobile users who are early in their financial journey. As new products like loans and insurance launched, users struggled to understand which Plan Center offers applied to them and why. The Plan Center lacked personalization and context, which made offers feel disconnected from real life needs. This led to lower engagement and missed value for both users and the business. The goal was to guide users to relevant financial products while keeping the experience simple and focused.

Constraints

• Mobile first experience with limited screen real estate

• A broad user base with varying levels of financial literacy

• Tight MVP timeline and limited engineering capacity

• Need to balance personalization with revenue driven metrics

Research

I partnered with research and data teams to review existing behavioral insights and conducted customer surveys to understand which life events most influenced financial decisions.

We identified common milestones tied to uncertainty and financial stress, including relationships, housing, education, career changes, and transportation. I also reviewed Plan Center usage data within the mobile app to identify drop offs, engagement patterns, and friction points.

These insights helped ground the solution in real user needs rather than assumptions.

Hypothesis

Giving users relevant recommendations for their needs in the context of where they are in life and their financial journey will decrease distractions and focus users on what they need.

This will increase plan center to offer tap conversion rates and subsequently revenue.

Personalized Offers (Recommendations)

Begin to personalize offer recommendations for Stashers. This will lead us toward better support of Stashers and better business outcomes.

Pain points:

I'm not sure what insurance, loans, or other financial tools I need at this stage in my life.

I think I need "X" but I am not sure when or why.

I want help on my financial journey more holistically (this is something we can expand into).

Approach

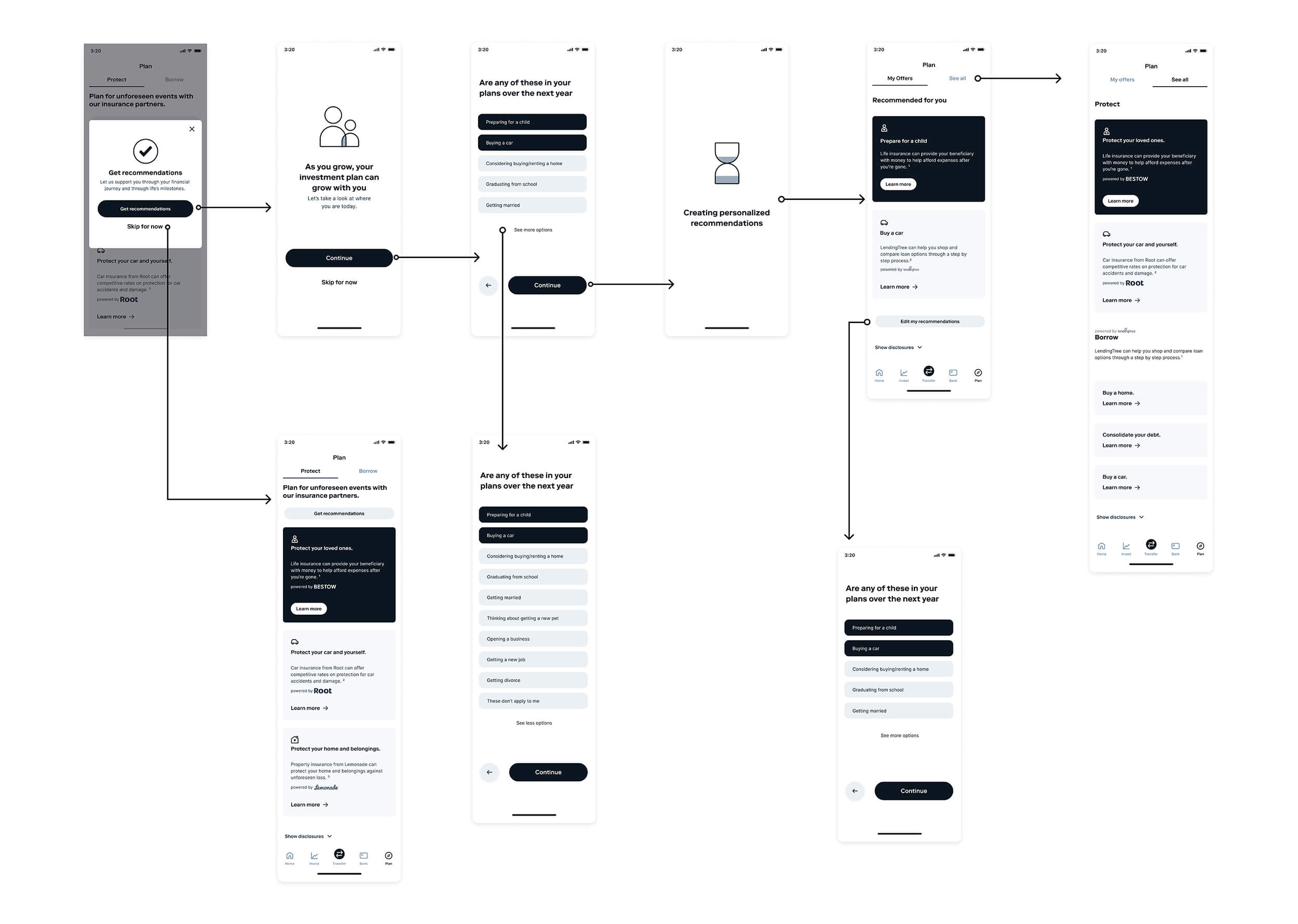

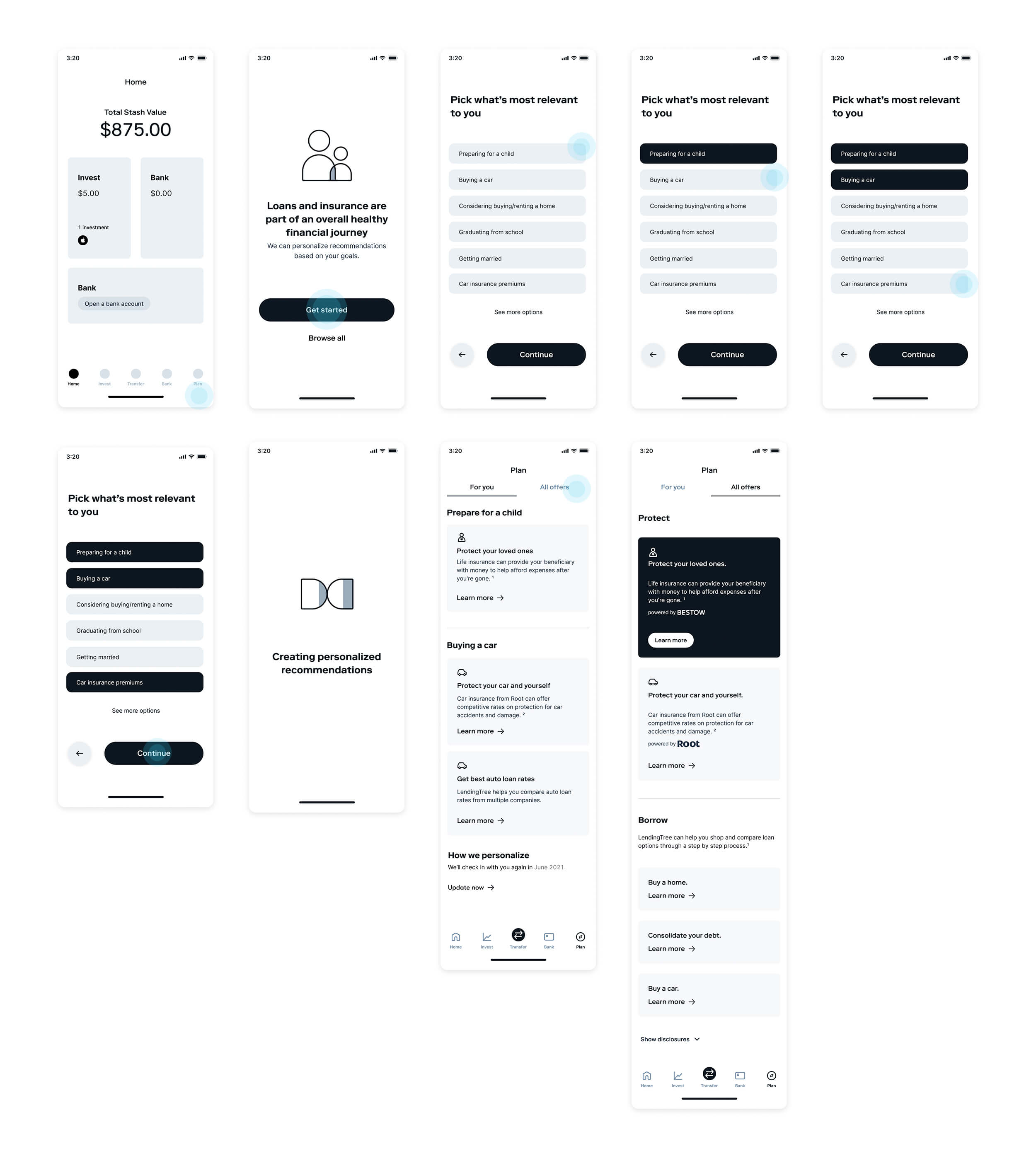

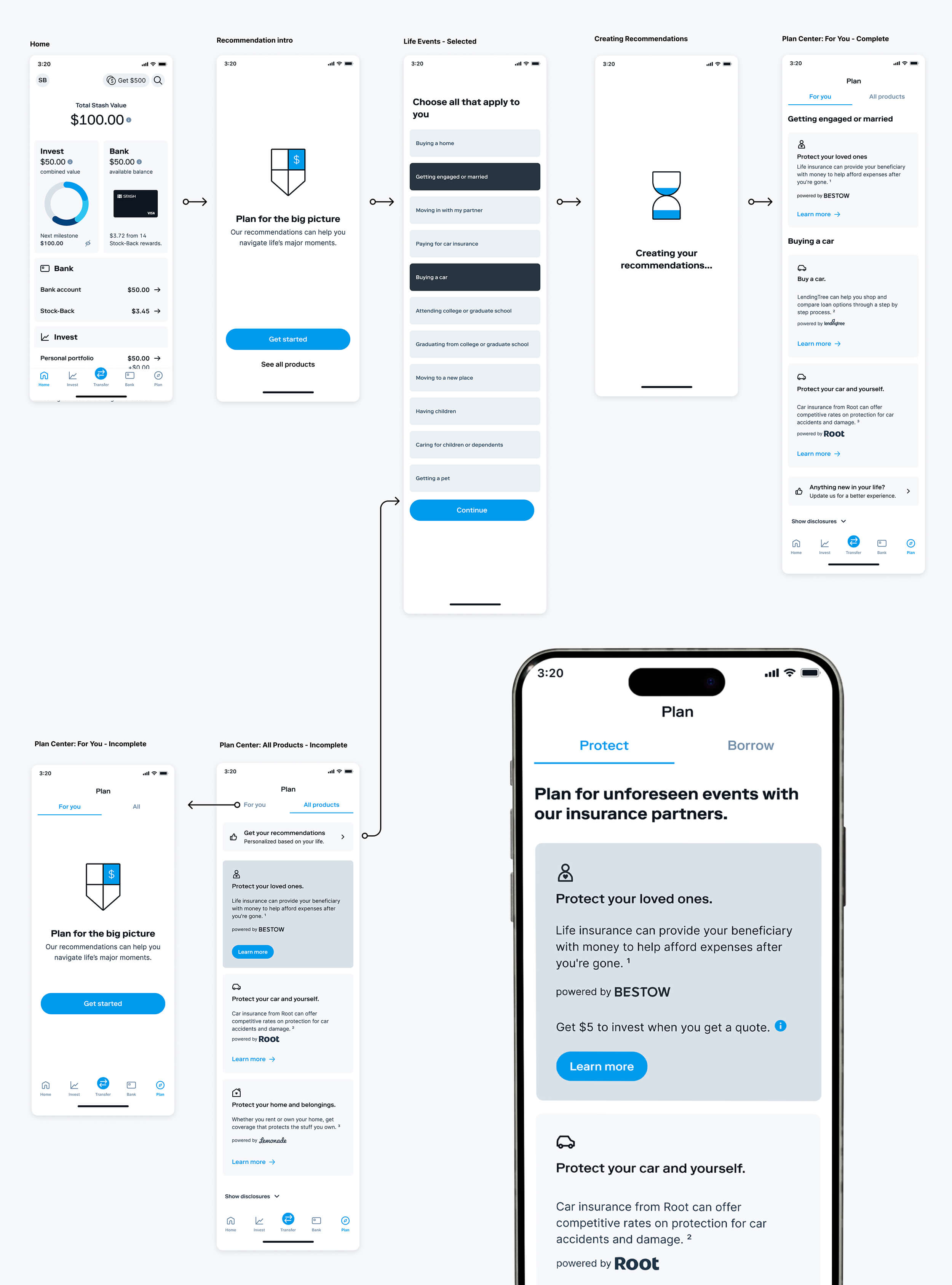

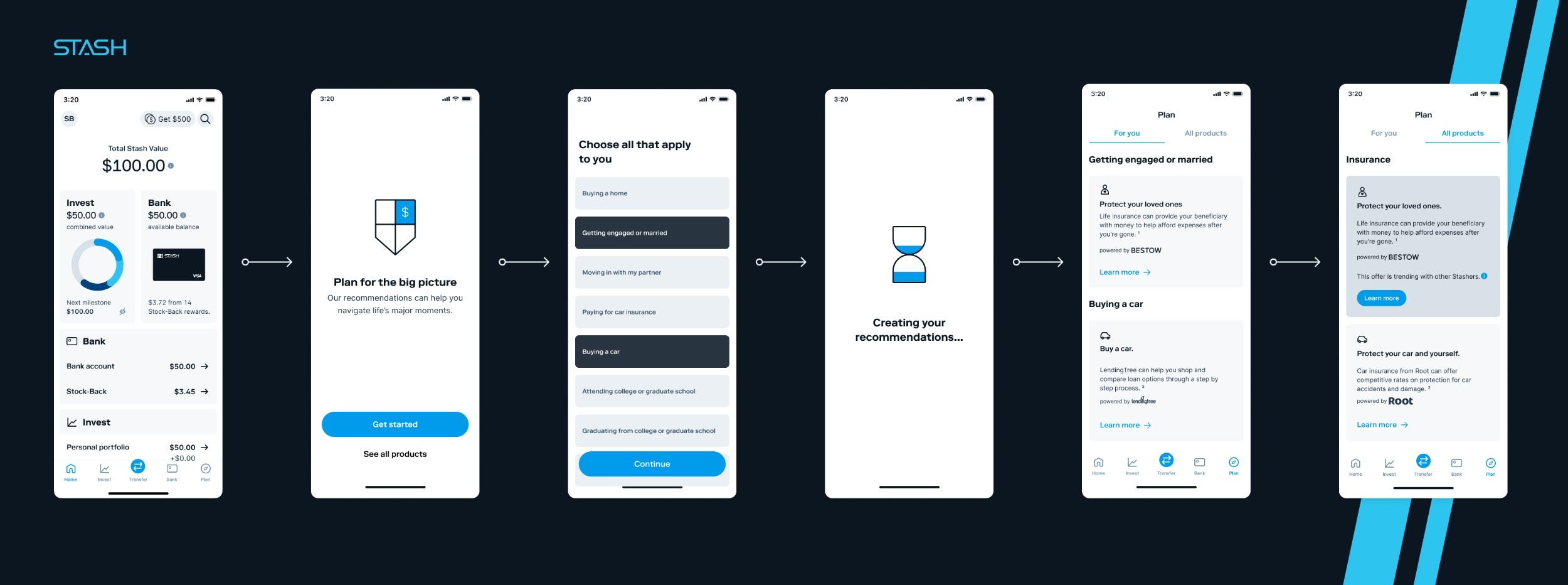

I reframed the Plan Center around life context instead of financial categories. Rather than asking users to browse products, the mobile flow asked what was happening in their life right now.

I designed a lightweight onboarding and selection flow optimized for mobile that allowed users to choose relevant life milestones. Based on those inputs, the app generated personalized recommendations aligned with loans and insurance offerings.

Design decisions focused on clarity, scannability, and trust. I reduced visual noise, emphasized hierarchy, and ensured each recommendation clearly explained why it was relevant to the user.

Final Designs

Solution

Life based personalization

Users selected life milestones such as getting married, buying a car, starting a new job, or moving, directly within the mobile app.Guided mobile flow

A short, focused flow minimized cognitive load and helped users reach relevant recommendations quickly.Clear value communication

Each recommendation explained what the product offered and how it supported the user’s current situation.

Final designs included mobile onboarding, milestone selection, loading states, and personalized Plan Center recommendation views.

Outcomes

The mobile MVP validated the impact of contextual recommendations on both user engagement and revenue.

• 347K dollars in revenue from new in app offers by March 2021

• 463K dollars projected revenue goal for June to July 2021

• 99.5 percent of mobile users gained access to all loan and insurance types

• 2.4 million unique mobile users clicked at least one offer

• Improved clarity and engagement within the Plan Center on mobile

Reflection

• Mobile simplicity requires constant prioritization

• Personalization works best when anchored in real life context

• Clear value explanations build trust in financial products

• Focused MVPs move faster and deliver stronger learning